Global London Focus: Dechert

London headcount: 169 lawyers: 44 partners (26 equity, 18 non-equity) Lawyer headcount change since 2013: +29% London office management committee:…

London headcount: 169 lawyers: 44 partners (26 equity, 18 non-equity) Lawyer headcount change since 2013: +29% London office management committee:…

‘Initially the client was concerned, but the investment banks said: “A big tick for Gibson Dunn in public M&A…

To mark the launch of our 2019 Global London report, we ask senior management at the leading US firms in…

Akin Gump Strauss Hauer & Feld led the way in the City lateral market last week after hiring two funds…

A year after becoming the first law firm to break the $3bn barrier, Latham & Watkins has posted an even…

Further evidence of significant lateral movement between US players in London emerged today (7 February), with news that one the…

Herbert Smith Freehills (HSF) is advising entertainment and communications company ARRIS on its proposed $7.4bn acquisition by CommScope Holding Company.…

China and Hong Kong are becoming increasingly challenging places for the global elite as the competition for talent from local…

An array of City and US firms have landed roles advising on Boston Scientific’s buyout of British healthcare firm BTG…

Alex Novarese, Legal Business: Ten years ahead, what will a global elite firm look like? Charlie Jacobs, Linklaters: I don’t…

They said rapid growth is hard if you are already big. Last year it hiked revenue 19% from $2.65bn. They…

In a deal of major national significance, Holman Fenwick Willan (HFW) and Clifford Chance (CC) have advised the Greek state…

‘It was so long ago,’ reflects Malcolm Sweeting, Clifford Chance’s (CC) senior partner, of his promotion to partner in 1990.…

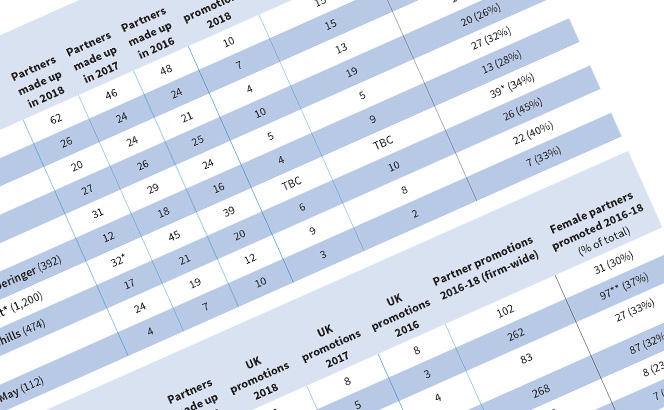

The Partnership Scoreboard – Trends and tribulations As part of our analysis of the modern realities of partnership, Legal Business…

Despite much talk of client pressure on fees the determination to recruit top associates continues to build with one leading…

A former Locke Lord partner who played a key role in the US firm receiving the largest ever fine from…

Striking numbers abound in this year’s Global London table, if you are into that kind of thing. The three pace-setting…

To mark the launch of our 2018 Global London report, we ask senior figures at leading US firms in London…

Kirkland & Ellis has hiked revenues by more than $500m to overtake Latham & Watkins as the world’s highest-earning law firm,…