Comment: Are stressed junior lawyers being struck off too easily? It’s time for watchdogs to consider a more flexible approach

In my line of work you’re supposed to pretend ideas come out of nowhere but this column was triggered by…

In my line of work you’re supposed to pretend ideas come out of nowhere but this column was triggered by…

Freshfields Bruckhaus Deringer has brought to an end a lawsuit brought against the firm by the liquidator of the insolvent…

Richard Harris on the impact of the preoccupation with banking mistakes History abounds with examples of problems to which a…

Chris Brennan follows on from his panel discussion at the Financial Services Regulation and Disputes Summit to explore the options…

A clear focus on a number of #MeToo episodes among City law firms has led to a close examination of…

Law firm culture is again under the spotlight after a survey of almost 7,000 lawyers across 135 countries found sexual…

Ten years ago, very few large law firms needed external legal advice on dealing with their regulator. This was because…

The risks and exposures facing law firms have dramatically changed over the last decade. The legal industry now faces a…

An under-wraps independent review of Baker McKenzie’s approach to a sexual misconduct incident six years ago has concluded there were…

The decade since the fall of Lehman has seen some dramatic changes to the profession, not least law firms’ risk…

Our debut risk management and professional indemnity report with broker Marsh in February 2008 featured a timid segue into an…

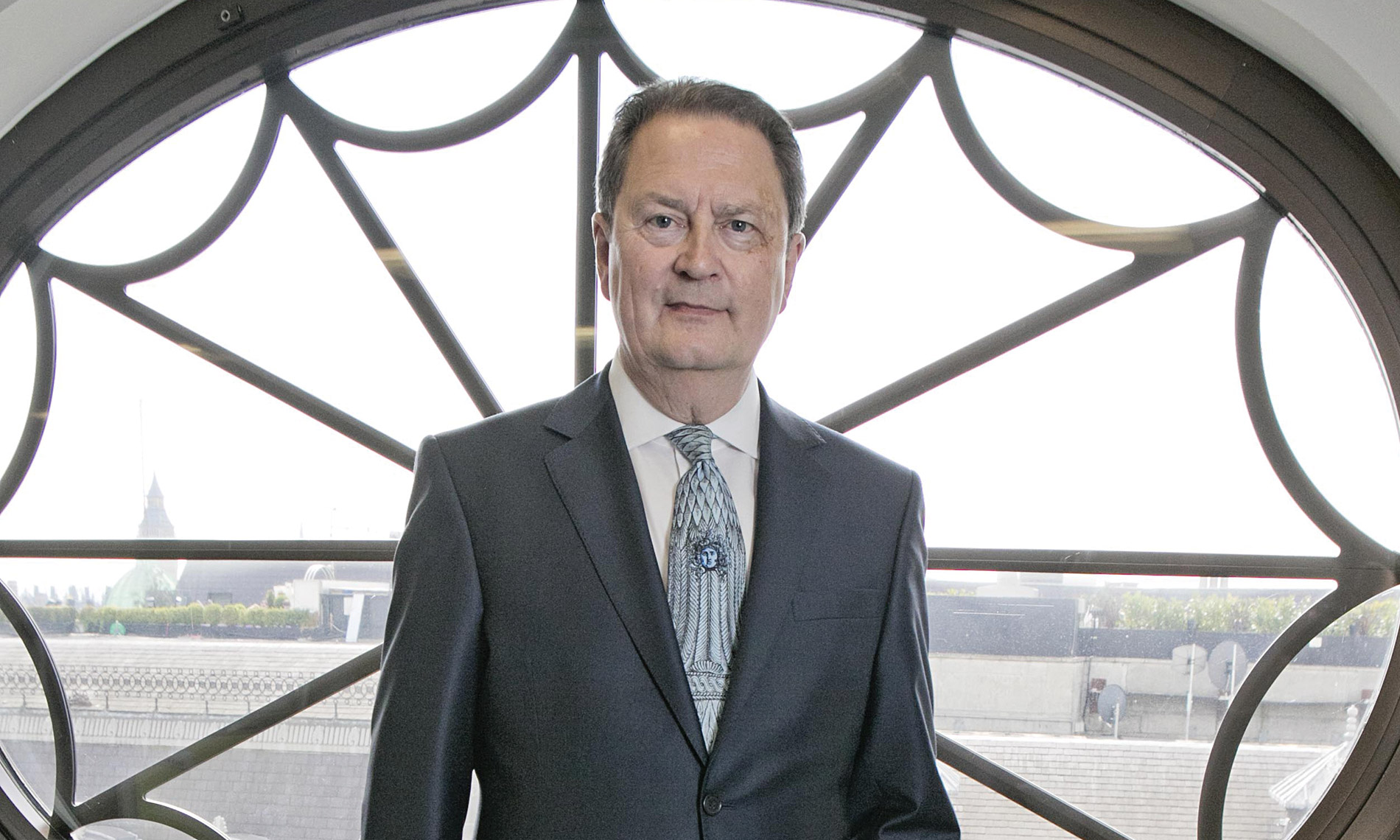

After an eminent career in later years dominated by picking up the pieces of the post-Lehman world, former Slaughter and…

Tom Baker assesses attempts to revive the flagging Serious Fraud Agency amid a fractious political debate It is fair to…

Global cartel fines have decreased significantly in the first half of 2017 with worldwide fines totalling $1.2bn, on track to…

White & Case and Sullivan & Cromwell have advised Deutsche Bank as Germany’s largest lender has been fined £500m by…

Envisaged in the wake of the financial crisis, ring-fencing reforms will tie up banks and legal advisers for years. Legal…

With new legislation putting human rights on the business agenda, we teamed up with Herbert Smith Freehills to gather lawyers…

With corporate counsel consistently burdened by onerous cost constraints levied by their executive, the pressure to deliver efficiencies in-house may…

With regulatory focus on financial services business unrelenting, effective risk management strategies are vital. We teamed up with Cornerstone Research…

Tapestry’s Janet Cooper on regulatory developments affecting pay in financial services. Since 2009, regulators around the world have been issuing…