As foreign advisers size up Africa, CC linked to alliance bid in South Africa

South Africa has faced more than its fair share of economic and social challenges in recent years, but with foreign…

South Africa has faced more than its fair share of economic and social challenges in recent years, but with foreign…

Eversheds is significantly expanding its Africa offering and is currently in discussions to establish offices in the key markets of…

The start of September has seen international firms reinvigorate their expansion plans, with Clyde & Co revealing an Indonesian alliance…

So far the high-stakes merger between Norton Rose and US practice Fulbright & Jaworski has been sealed with minimal fall-out…

Post-banking crisis, the world has generally divided fairly neatly into two camps with their clear economic narratives. On one hand…

The increased importance of Turkey as strategic hub for international firms has been underlined with news that US firm Edwards…

Herbert Smith Freehills (HSF) is to end its five-year exclusive tie-up with Saudi Arabia’s Al-Ghazzawi Professional Association (GPA), as international…

In a Tel Aviv conference in June this year, DLA Piper, White & Case, Freshfields Bruckhaus Deringer and Weil, Gotshal…

Ashurst’s recent appetite for international expansion shows no sign of abating, with the firm announcing in November the launch of…

Recently it seems that not a week goes by without new clamour surrounding another legal market as law firms race…

Squire Sanders expanded both its Middle East and South Korea operations in October, as Latham & Watkins reported a surge…

The resurgence of commercial activity in the Middle East is prompting international law firms to strengthen their presence in the…

There is something momentous unfolding in the Gulf. The wave of protests and general revolutionary feeling that has swept through…

Freshfields Bruckhaus Deringer’s ‘man on the ground’ in Tel Aviv, Adir Waldman, had a relatively typical New England upbringing. Having…

As Africa’s emerging economies continue to lure investors, a new legal geography is evolving to accommodate increasing cross-border traffic. LB…

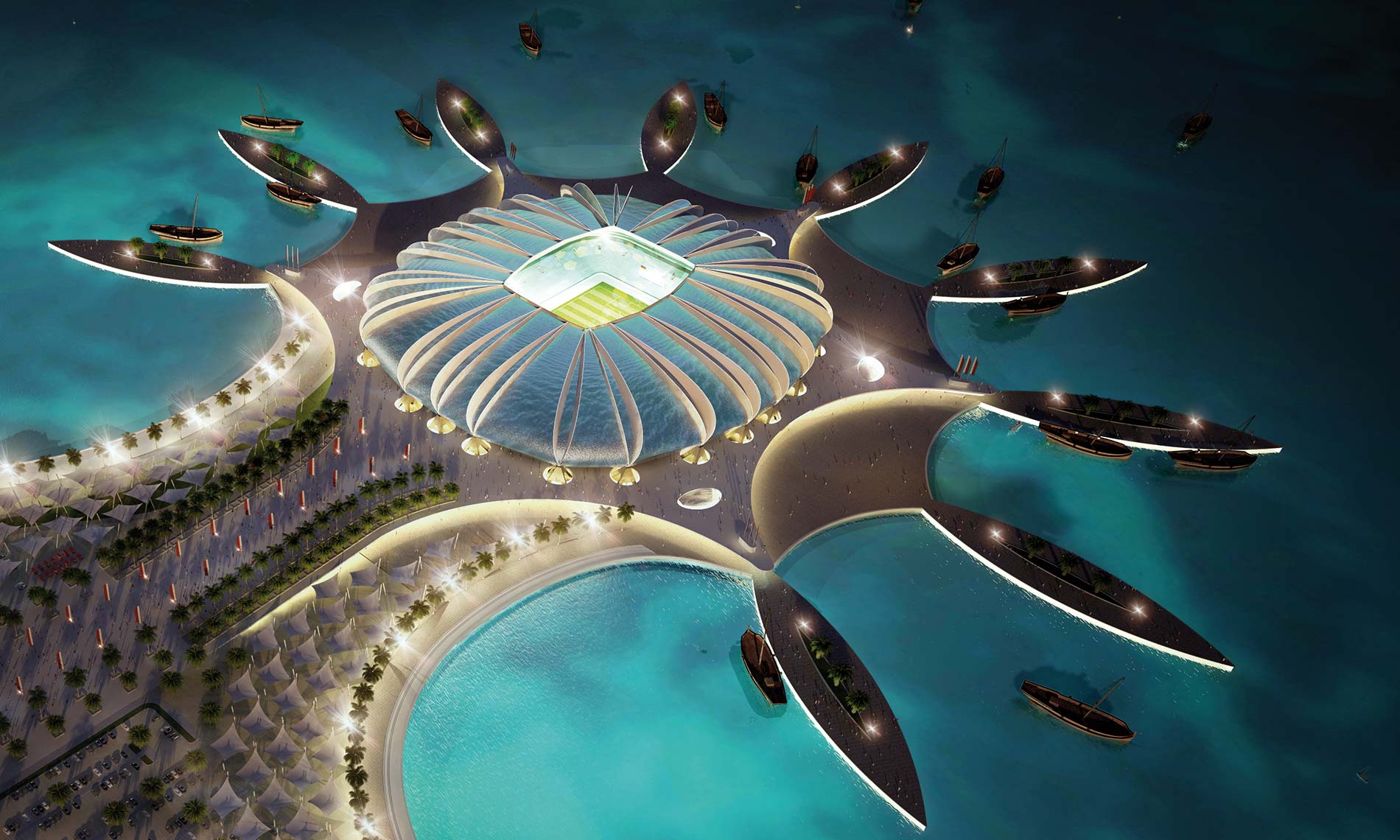

On 2 December 2010 FIFA, the international governing body of football, officially announced that a desert state would be hosting…

As the Arab Spring spreads across the Middle East, investors are flocking to safe ground. LB discovers which states will…

As its economy booms Turkey has attracted the attention of the world’s legal market. Will Clifford Chance and DLA Piper’s…

Everything seems to conspire to prevent all but the most adventurous and patient of investors from entering Angola. A room…

Amid leaner times in the Gulf and a flat economy in Dubai, international clients are moving their focus to other…