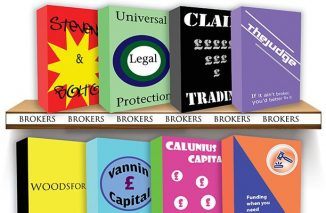

In its first financial results since the £43m IPO in May, Rosenblatt has recorded a slight uptick in revenue and profit as it simultaneously launched its own litigation funding arm.

For the first eight weeks of its listed life, Rosenblatt generated £3m in revenue, compared to £2.6m for a two month average in the last financial year. EBITDA edged up from £0.9m to £1m on the same metric while profit before tax was also marginally up: from £0.8m to £0.95m. Continue reading “Rosenblatt battles Brexit uncertainty in post-IPO financials as it launches litigation funder”