Global London: Flying hiatus

While no two years are ever quite the same in the world of Legal Business’ Global London report, the story…

While no two years are ever quite the same in the world of Legal Business’ Global London report, the story…

Overview: Flying hiatus Covid-19 has intensified the divide between the Global London firms that have really taken off and those…

London headcount: 91 lawyers, 28 partners Lawyer headcount change since 2015: +38%

London headcount: 132 lawyers, 28 partners Lawyer headcount change since 2015: + 25%

The issue on every European partner’s lips in our Global London report in 2016 was the outcome and fallout of…

Sponsored by Part 1: The Overview ‘Vantage points’ Focus: Cleary Gottlieb Steen & Hamilton Focus: Skadden, Arps, Slate, Meagher &…

White & Case’s City revenue fell almost 4% over the last financial year following a ‘challenging’ start to 2019, while…

Disputes heavyweight Quinn Emanuel Urquhart & Sullivan has continued its impressive growth in the City, with revenue at the firm’s…

Morrison & Foerster (MoFo)’s City revenue has lifted 25% for a third consecutive year, outpacing a strong global showing and kicking…

There was never any doubt that 2018 would prove another good year for US law firms in London coming off…

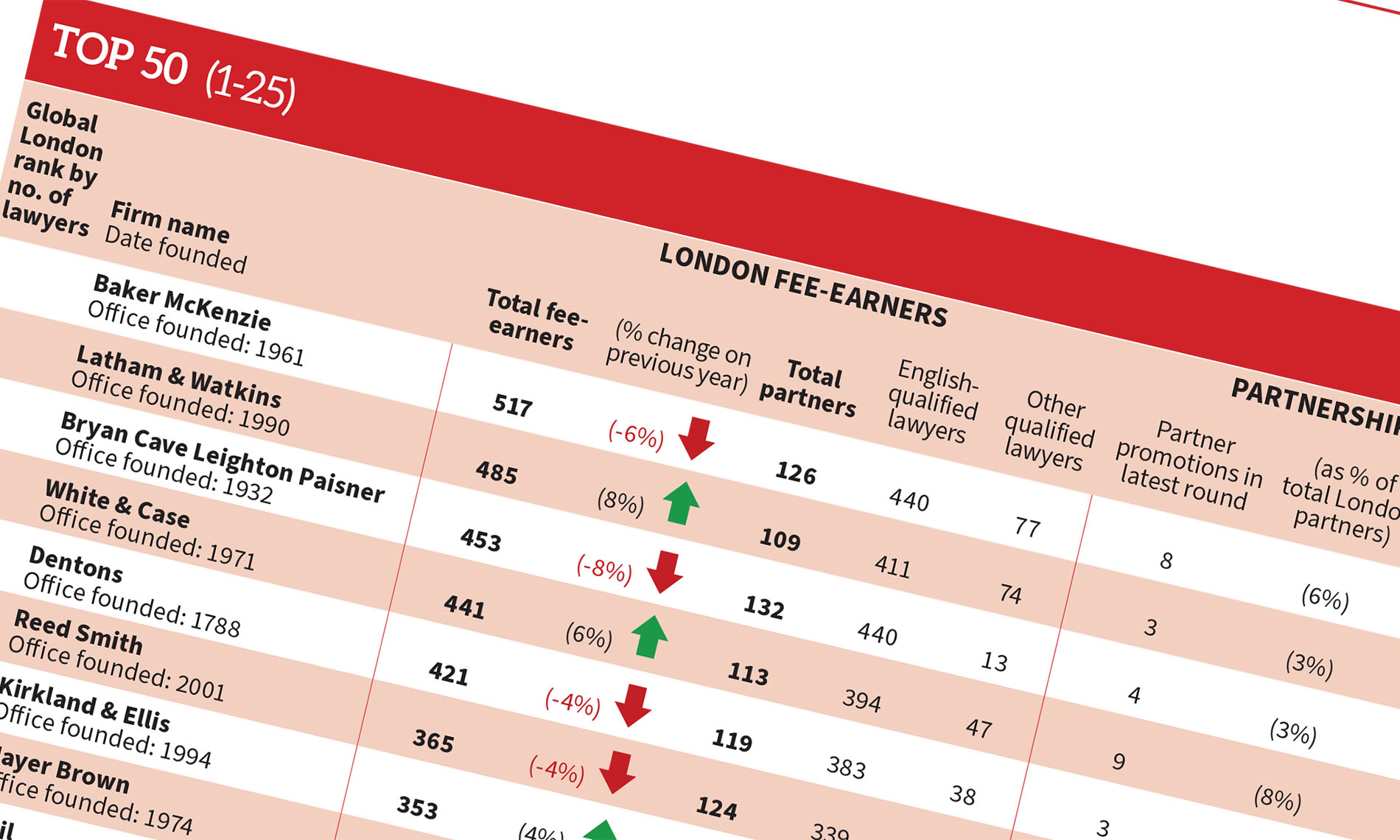

Striking numbers abound in this year’s Global London table, if you are into that kind of thing. The three pace-setting…

Legal Business‘s 15th annual Global London survey assesses the impact of a seismic year on the City’s leading US and…

Menu Swoop to conquer – a turbulent year for US firms in London but no retreat Global London 2017 –…

London office headcount: 165 lawyers, 42 partners Fee-earner headcount change since 2011: +72% London office management committee: Camille Abousleiman (chair),…

London office headcount: 134 lawyers, 45 partners Fee-earner headcount change since 2011: +17% London head: Matthew Dening Office speciality: Funds,…

To mark our annual Global London report, Legal Business teamed up with Venturis Consulting to assess the dramatic progress made…

The firms that appear in Global London are the 50 largest non-UK originated firms in London, ranked by headcount. Partner…