What does it take to be part of the global elite? When Legal Business unveiled the very first iteration of its ‘global elite’ back in 2003, 15 firms made the grade, of which six were headquartered in the UK.

They were selected based on criteria including: being a leader in their home jurisdiction in at least two of the three key practice areas of finance, M&A and litigation; being one of the 50 most profitable firms in the world; and being a leader in M&A or banking on both sides of the Atlantic.

But with law firms expanding rapidly around the world in the time since that first elite was created, the metrics they should be assessed on have come under increasing scrutiny.

Should the measure of success be firmwide revenue, international revenue, profitability, headcount or perhaps geographic spread? Or should the true global elite simply be a list of the very best law firms in the world? In which case, the likes of Slaughter and May and Wachtell would make the grade despite a decided lack of international reach.

Twenty-one years after that first 15-firm group was drawn up, despite having more data available to us than ever before, it is perhaps less clear now who should and shouldn’t be included in a global elite than it was then.

The Global 100 ranking in this issue is a prime example. US firms make up roughly 70% of the biggest firms in the world by revenue; while there are fewer than 20 UK or equal UK/US heritage firms in the list. And the sheer size of the US legal market means that its domination over UK and international firms only increases year on year.

Similarly, the difference in approach towards global expansion (with UK firms generally having larger numbers of lawyers in more international locations than their US peers) means the profitability gap also continues to grow.

But, despite their strong financial performance, many of the US firms in the global elite lack any significant international footprint, which inevitably means that our Global 100 rankings are not really as globally-focused as they should be.

So we have decided to go back to basics, and revisit the questions of what it really means to be global, and what it really means to be elite.

Thinking global

Ask managing partners what global means and responses inevitably differ depending on the profile of the firm.

For Justin D’Agostino, global CEO of Herbert Smith Freehills: ‘It’s the quality of clients, the quality of the work you’re doing for them, and the quality of your talent. You also need geographic reach in the major markets of the world. It’s about strength, profitability, and sufficient scale.’

Simon Levine, DLA’s global co-CEO and international managing partner, says being truly global is about being able to offer the biggest corporates in the world the full breadth of services – from life sciences, to disputes, to regulatory advice – across multiple jurisdictions.

He asks: ‘When major global organisations – like Unilever, GE, or HSBC – require critical global services such as restructuring, dispute resolution, or regulatory advice, do they need to turn to multiple firms, or can one firm manage everything?’ In his view: ‘Simply focusing on corporate, M&A, PE, and litigation isn’t enough.’

On the other hand, one London head at an elite US firm counters: ‘I don’t think just being big makes you global. It’s about which markets you’re deep in, combined with an element of profitability’.

The US conundrum

What everyone – including LB – is in agreement on is that being truly global requires a presence in the key financial centres around the world. That means London, the US, and major financial centres across Asia Pacific and EMEA such as Hong Kong and Frankfurt.

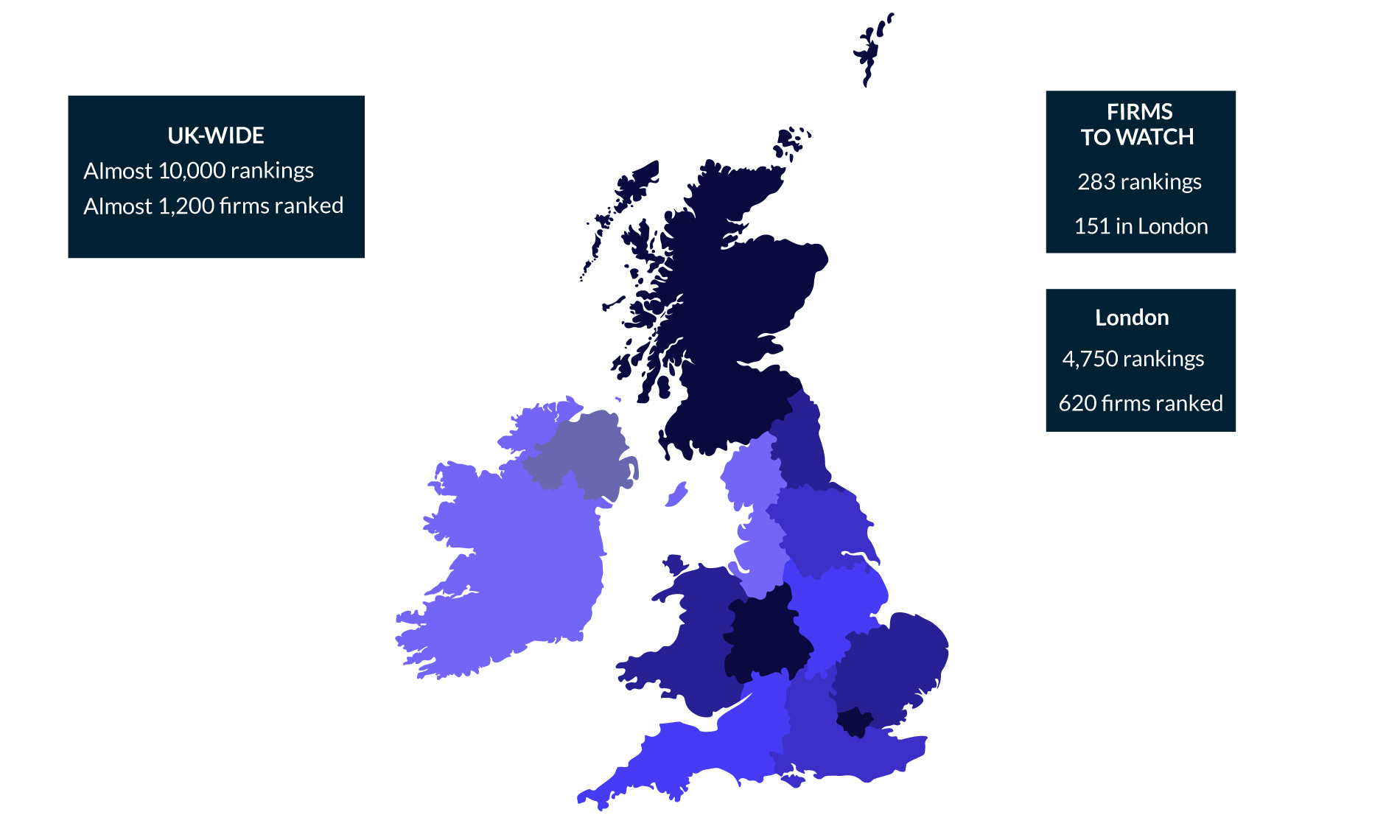

Here then, we’re presenting some new options for what it really means to be a globally elite firm by revisiting some of those 2003 criteria and combining them with definitive insight from our Legal 500 rankings.

Where UK and UK-heritage firms fare best is strong global coverage, as evidenced by their L500 rankings.

If we look at the global 100 firms by total number of L500 rankings worldwide, our top ten firms comprise: DLA Piper, Baker McKenzie, CMS, A&O Shearman, Dentons, Eversheds Sutherland, Clifford Chance, Hogan Lovells, White & Case and Norton Rose Fulbright.

Look at the best-performing global 100 firms by total number of top-tier Legal 500 rankings worldwide and the picture shifts slightly, but UK and UK-heritage firms still come out on top, with Bakers, A&O Shearman, CC, DLA Piper, CMS, Linklaters, Latham, Dentons, HSF and Pinsents making the grade.

But while UK-heritage firms are strong across key financial centres such as Hong Kong, Singapore and Frankfurt, to be truly global firms have to have a solid presence in all four L500 regions: UK, EMEA, APAC and the US.

Making this a prerequisite for inclusion in a global elite proves to be almost as big a blocker for many UK-heritage firms today as it was in 2003 – but with a bigger profitability gap to navigate to fix the problem. For example, of those leading firms by T1 rankings, CMS, HSF, Linklaters and Pinsents all lack any T1 rankings in the US.

As D’Agostino admits: ‘the quality of [UK firms’] client base and our scale in major markets is still a force to be reckoned with, but all of us are focused on the US market and how to scale up.’

Duncan Weston, executive partner at CMS, comments: ‘Many law firms like to call themselves global, but they’re not. We don’t claim to be truly global yet, though we have those aspirations,’ he admits, pointing to CMS’s gaps in key markets like Asia and the US. Of course, T1 or not, not all L500 rankings are created equal. Echoing the approach LB took back in 2003, for elite status, let’s now consider only firms with at least one ‘prime’ L500 ranking (corporate/M&A, litigation, banking and finance) in major markets across all four core geographies – Asia Pacific, EMEA, the US and the UK. Again, UK-heritage firms still fare pretty well, with A&O Shearman, CC, DLA Piper, Linklaters, Hogan Lovells, Norton Rose Fulbright and polycentric Dentons all making the cut.

But now let’s add one of those other 2003 criteria: in addition to being global we want our list to be elite. So, for this, let’s add in the same profitability filter applied in 2003 –considering only the 50 most profitable global 100 firms.

Removing firms in the bottom half of the profitability table equates to a cut-off point of $2.38m based on this year’s financial results, meaning large but less profitable players like Bakers and Norton Rose Fulbright fall out.

So what are we left with? In total we end up with a list of around 20 firms, with UK or UK-heritage firms making up around six of the top ten by total ranking numbers (see tables below).

Of course, some may query the value placed on an EMEA and APAC presence – particularly given current scrutiny over whether a huge global footprint is as important as it once was. And others may query taking a volume-based approach to rankings.

But a true global elite needs to be made up of firms with broader horizons than just the US firms which make up so much of the Global 100. Otherwise it’s just a US elite.

Georgina Stanley and Anna Huntley

Global 100 firms with the most prime* L500 rankings across APAC, EMEA, UK and US (top 50 for PEP only)

| Firm |

APAC |

EMEA |

UK |

US |

Total |

| A&O Shearman |

20 |

49 |

25 |

23 |

117 |

| Clifford Chance |

16 |

46 |

16 |

14 |

92 |

| DLA Piper |

14 |

49 |

14 |

15 |

92 |

| White & Case |

14 |

38 |

17 |

20 |

89 |

| Latham & Watkins |

13 |

24 |

15 |

27 |

79 |

| Linklaters |

11 |

43 |

17 |

5 |

76 |

| Hogan Lovells |

10 |

37 |

17 |

10 |

74 |

| Freshfields |

8 |

28 |

14 |

11 |

61 |

| Mayer Brown |

8 |

8 |

15 |

25 |

56 |

| Skadden |

11 |

5 |

10 |

25 |

51 |

Global 100 firms with the most T1 prime* l500 rankings across APAC, EMEA, UK and US (top 50 for PEP only)

| Firm |

APAC |

EMEA |

UK |

US |

Total |

| A&O Shearman |

9 |

24 |

19 |

1 |

53 |

| Clifford Chance |

7 |

26 |

15 |

0 |

48 |

| Latham & Watkins |

3 |

8 |

6 |

21 |

38 |

| Linklaters |

6 |

17 |

11 |

0 |

34 |

| Kirkland & Ellis |

4 |

2 |

4 |

9 |

19 |

| White & Case |

3 |

9 |

4 |

2 |

18 |

| Simpson Thacher & Bartlett |

2 |

0 |

1 |

15 |

18 |

| Cleary Gottlieb Steen & Hamilton |

1 |

3 |

0 |

10 |

14 |

| Freshfields |

2 |

7 |

4 |

0 |

13 |

| Davis Polk & Wardwell |

1 |

0 |

0 |

12 |

13 |

* Prime = at least one core M&A/banking/litigation ranking