The phrase has long been a cliché among industry circles, but no-one is better at being cautiously optimistic than a law firm leader. For years, individuals have been compelled to temper any bullishness on market outlook with a healthy recognition that disaster is probably just around the corner. After all, few things make the sting of a downturn worse than the humiliation of hubris. Yet this year’s Legal Business 100 (LB100) has again seen all those risk-averse catastrophists not only surviving but thriving.

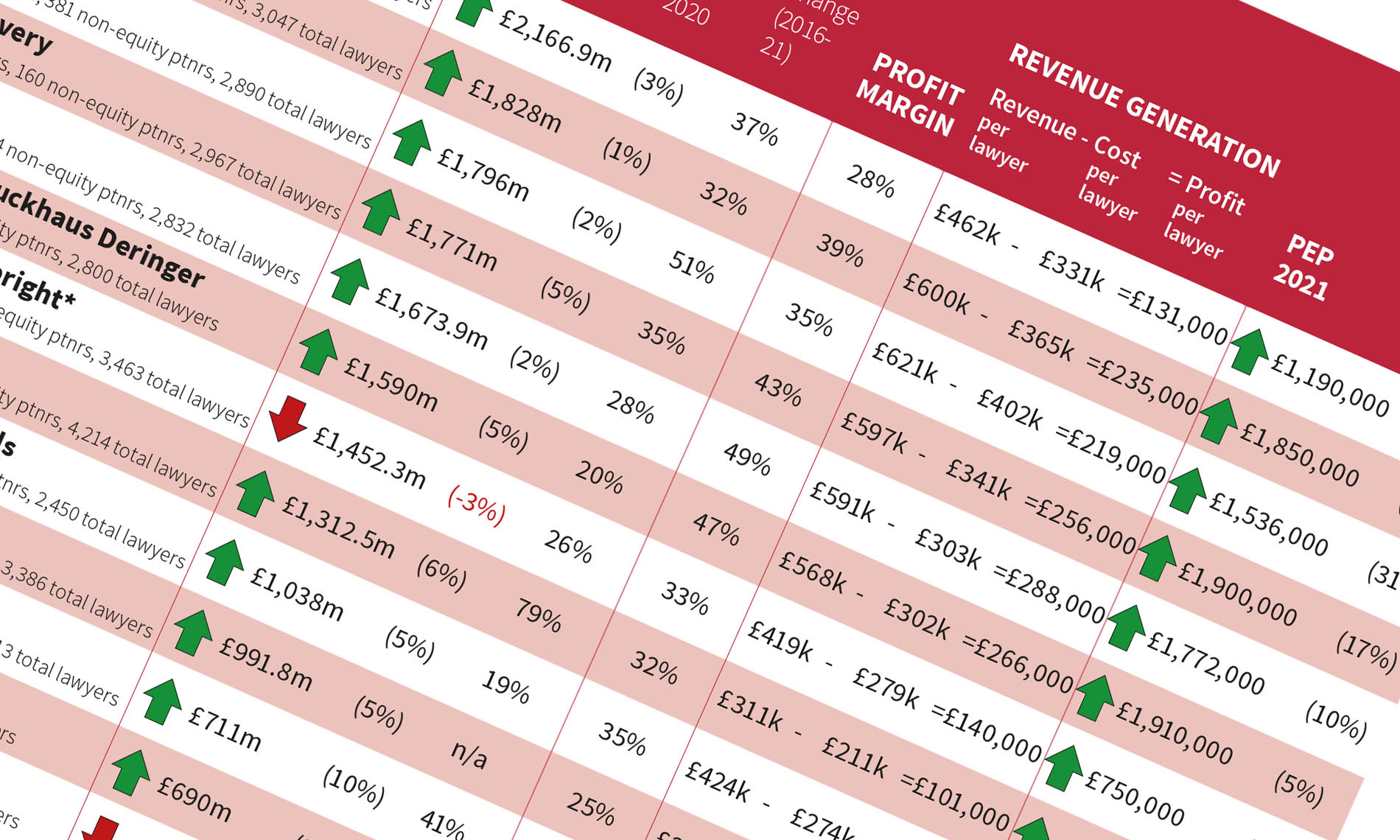

To say much has changed since our 2020 report would be an understatement. Last year in profit terms, the message was clear that firms were cutting their cloth accordingly in light of a seemingly inevitable bout of financial turbulence in the year to come. Continue reading “LB100 Overview: Marathon, not a sprint”