A cursory glance at The Legal 500’s IP coverage – which was recently split into a distinct patents table alongside a trade marks, copyright and design table – makes for a head-scratching read. In a legal discipline that attracts sophisticated, technical expertise, fortune favours the innovative as much as the who’s who of the City elite, or indeed the prestigious US names that are continually encroaching on London territory in the corporate space. Continue reading “Validity in the opposition”

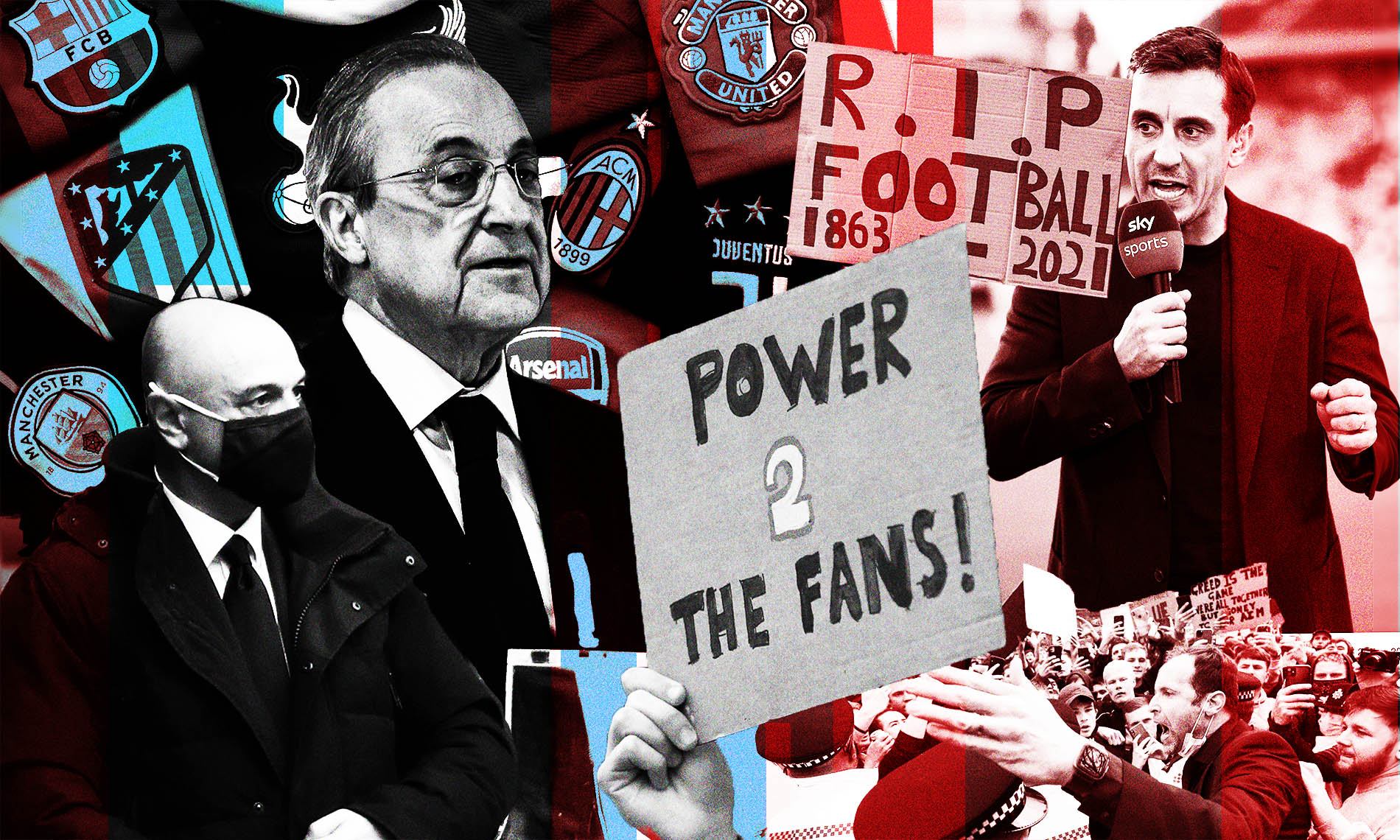

Caught offside

It was the football story of the year – eclipsing even Lionel Messi’s move to PSG and football not quite coming home – almost beyond belief in its audacity. On Sunday 18 April, The Times broke a story that 12 leading clubs from England, Spain and Italy had agreed to break away from UEFA’s Champions League competition and launch their own independent format: The European Super League (ESL). Continue reading “Caught offside”

Banking on battles

The In-House Lawyer (IHL): What has been keeping you busy in banking litigation over the past 12 months? Continue reading “Banking on battles”

General overview of the Lithuanian court system

The Lithuanian court system consists of courts of general jurisdiction and specialised courts.

Continue reading “General overview of the Lithuanian court system”

Challenging arbitral awards before the Hong Kong courts

While an agreement to settle disputes through arbitration means that the parties have contracted to have their dispute resolved away from the Courts, an aggrieved party can still (in limited circumstances) challenge an arbitral award in Court. Continue reading “Challenging arbitral awards before the Hong Kong courts”

What to watch – top trends and risks in banking litigation

Following 18 months dominated by the Covid-19 pandemic, banks like other businesses might have hoped for some respite. Instead, as we come out of the pandemic banks continue to face a wide and growing range of risks which may well result in the busiest period for banking litigation since the financial crisis. This will likely be combined with increased regulatory activity: the FCA has made clear that it intends to adopt a more assertive approach to enforcement, as well as prioritising customer welfare by introducing a Consumer Duty for financial institutions. We summarise below some of the major trends and risks in this space. Continue reading “What to watch – top trends and risks in banking litigation”

Norwich Pharmacal Orders against service providers in Cyprus in aid of execution of a judgment issued abroad – recent court judgment provides guidance

In recent years it has become more and more common for service providers in Cyprus, acting either as nominee directors, nominee shareholders or trustees of clients, to be the recipients of applications for the issue of disclosure orders against them in aid of foreign proceedings that are pending or will be initiated in the future against their clients. Continue reading “Norwich Pharmacal Orders against service providers in Cyprus in aid of execution of a judgment issued abroad – recent court judgment provides guidance”

I want to break free: opting out of class litigation

Conventional wisdom tells us there is ‘power in numbers’, but that is not always true in litigation. While class actions are a powerful tool – particularly where damages to each injured party are relatively small – they can also be cumbersome. Class-action proceedings can take years to wind themselves through United States courts. The cases are expensive. And courts have made it more difficult to obtain class certification in recent years. Continue reading “I want to break free: opting out of class litigation”

What is commercial litigation?

In Egypt, a commercial dispute arises between business entities (such as partnerships and corporations of different types) and/or merchants as defined generally under the Egyptian Commercial Law. Commercial litigation in Egypt is similar to commercial litigation in other civil law jurisdictions such as France and the rest of the MENA region in regards to both form and function. Any litigant that has previously litigated in a civil law jurisdiction will not find any real surprises in commercial litigation in Egypt. Continue reading “What is commercial litigation?”

The power to appoint an administrator under the 2015 Insolvency Act

Introduction – The Insolvency Act 2015

Prior to the enactment of the Insolvency Act, No. 18 of 2015 (IA 2015) corporate insolvency in Kenya was governed by the repealed Companies Act (Cap. 486 of the Laws of Kenya), as read in conjunction with certain provisions of the repealed Bankruptcy Act of Kenya (Cap. 53 of the Laws of Kenya).

The primary purpose of the IA 2015 was therefore to inter alia amend and consolidate the law relating to the insolvency of incorporated and unincorporated bodies; to provide for the liquidation of incorporated and unincorporated bodies (including ones that may be solvent); and to provide as an alternative to liquidation, procedures that would enable the affairs of insolvent entities to be administered for the benefit of their creditors.

Of special interest for our purposes is the IA 2015’s introduction of the device of administration, replacing the appointment of receiver managers under the repealed Companies Act, and in turn enabling financially distressed companies to continue operating as going concerns. However, to benefit from the power to appoint an administrator without recourse to court, one must be the holder of a qualifying floating charge as defined under s534(1), IA 2015, and it is precisely herein that lies the conundrum which is the focus of this article.

Securities pre-dating The Insolvency Act 2015

The primary issue in contention is whether the holder of a debenture created prior to the coming into force of the IA 2015 qualifies to appoint an administrator pursuant to the provisions of s534 of the Act. In this regard, the Kenyan High Court has delivered two conflicting decisions.

Re Arvind Engineering Ltd [2019]

The first of these conflicting decisions is Re Arvind Engineering Ltd [2019], wherein the Company contested the appointment of an administrator by NIC Bank on the basis that the bank’s debenture pre-dated the coming into force of the IA 2015, and as such the debenture did not meet the threshold of a ‘qualifying floating charge’ as defined under s534(1) of the IA 2015.

The bank advanced the argument that since its debenture empowered it to appoint a receiver manager under the repealed Companies Act, then that power is deemed to include the power to appoint an administrator under the IA 2015. The bank further contended that barring it from appointing an administrator would mean that no holder of a pre-2015 debenture would be entitled to appoint an administrator suo moto, as they would be constrained to seek an appointment through the court.

In its reasoning, the court focused on the definition of a ‘receiver manager’ and noted that the duties and functions of a receiver manager are almost homogenous to those of an administrator. In particular, the court noted that a receiver manager (in distinction to a receiver) is obliged to act in the best interests of not only the debenture holder, but of the company in general, which is also a central objective of administration as per s522 of the IA 2015.

In conclusion, the court held that it was important not to disadvantage holders of debentures which pre-date the IA 2015, emphasising the need to give the provisions of s524 of the IA 2015 a purposive, as opposed to a restrictive, interpretation. Therefore, as the debenture in question allowed the bank to appoint a receiver manager, whose powers and functions are akin to that of an administrator, then the bank was deemed to have the power to appoint an administrator.

I&M Bank Ltd v ABC Bank Ltd & anor [2021]

In distinction to the matters in dispute in Re Arvind Engineering, the dispute in I&M v ABC emanated from the competing interests and rights of two secured creditors – one of whom held debentures pre-dating the IA 2015 (ABC Bank), while the other held debentures registered after the coming into force of the IA 2015 (I&M).

In a position comparable to that taken in Re Arvind Engineering, ABC submitted that since its debenture allowed it to appoint a receiver manager, whose powers and functions are similar to those exercisable by an administrator appointed under the IA 2015, its appointment of an administrator as opposed to a receiver manager was inconsequential and should be allowed to stand.

In opposing ABC’s appointment of an administrator, I&M submitted that the effect of s534 of the IA 2015 is that only creditors holding a qualifying floating charge (as defined) could appoint an administrator. For those who do not hold a qualifying floating charge, their recourse lay in making a formal application to court for the appointment of an administrator.

In arriving at its decision, the court agreed with the position taken by I&M and departed from the reasoning in Re Arvind Engineering. The court held that while the functions and duties of a receiver manager appointed under a debenture are conterminous with those of an administrator appointed under the IA 2015, this does not mean that the holder of a pre-2015 debenture is allowed to appoint an administrator. The court based its reasoning having regard to s520 of the IA 2015, which ascribes a specific meaning to the term ‘administrator’ and relates it to the manner of appointment rather than to the functions.

The court therefore held that while the powers of a receiver manager appointed under a debenture, and the powers of an administrator appointed under the IA 2015, may be conterminous, they cannot be equated to one another, and nor can the power to appoint a receiver manager be equated to appointment of an administrator by the holder of a qualifying floating charge.

In concluding, the Judge held that the debenture issued in favour of ABC was not a qualifying floating charge within the meaning of s534(2) of the IA 2015, and consequently ABC could not appoint an administrator without making an application to the court as a creditor under s532(1) of the IA 2015. However, the court also held that ABC is entitled to appoint a receiver manager under the debenture, as this power is specifically preserved under the transitional provisions of the IA 2015 (in particular, s734(2) thereof.

Analysis and conclusion

What is glaringly obvious from the above analysis is that the IA 2015 is still in its nascent form, and the bounds of its applicability to securities pre-dating its coming into force is a matter that is evolving and yet to be conclusively determined.

Of note is that the Court of Appeal has yet to settle the law and make a pronouncement on whether a party holding a pre-2015 debenture is entitled to invoke the provisions of s534 of the IA 2015 and appoint an administrator on its own motion, or whether such a party is constrained to make a formal application before court for an administration order pursuant to s532 of the IA 2015.

This article is for informational purposes only and should not be taken to be or construed as a legal opinion. If you have any queries or need clarifications, please do not hesitate to contact John Mbaluto, FCIArb ([email protected]),

Eva Mukami ([email protected]) or Radhika Arora ([email protected]), or your usual contact at our firm, for legal advice.

Trends in German commercial litigation

Climate change, data protection and cybersecurity litigation, as well as collective redress, are major trends and will have significant impact on key industries in Germany. Continue reading “Trends in German commercial litigation”

Enforcement of foreign judgments in Israel

After obtaining a favourable judgment in a foreign country, one may wish to enforce the judgment in Israel. This is the case, for example, when the debtor has assets in Israel or when the successful litigant seeks to enforce compliance with the provisions of the judgment on an Israeli citizen or company. As in many other judicial systems, a judgment rendered by a foreign country is not automatically recognised in Israel and must undergo an ‘acceptance’ proceeding to gain legal status – whether for the purpose of being enforced, ie, being executed, or in order to be recognised. Continue reading “Enforcement of foreign judgments in Israel”

Tax litigation in The Netherlands

Over the past couple of years, there have been many developments in the area of taxation domestically, at a European Union (EU) level and internationally that are relevant for in-house (tax) lawyers. This contribution highlights a selection these developments based on their relevance for in-house (tax) lawyers. Continue reading “Tax litigation in The Netherlands”

Class dismissed: the future of group litigation in the UAE

Once the preserve and a staple of US litigation, in recent years class action claims have gained traction in the English courts across a wide variety of sectors. Recent disputes have involved securities and shareholder litigation against financial institutions like RBS and Lloyds/HBOS, claims against large companies such as Tesco, actions arising out of breaches of data protection legislation against British Airways, easyJet and Morrisons, and arising out of product liability such as the VW diesel emissions testing scandal. Another area of significant growth for class actions in the UK has been in competition law, and the Supreme Court recently provided important guidance on the certification of collective action procedures before the Competition Appeals Tribunal in its landmark decision in MasterCard Incorporated & ors v Merricks [2020]. Continue reading “Class dismissed: the future of group litigation in the UAE”

Commercial litigation focus: the Bahamas

Overview of the Bahamian legal system

The Bahamas is a former colony of Great Britain, which attained independence on 10 July 1973 but acknowledges the Queen of England as its constitutional Head of State and maintains its identity as a common law jurisdiction. By the Declaratory Act passed in 1799, the English common law was declared to be the law of The Bahamas along with a superstructure of English statutes to which were added a succession of local statutes enacted by the local Parliament progressively. Continue reading “Commercial litigation focus: the Bahamas”

A guide to litigating contracts in New Zealand

Earlier this year, New Zealand’s highest court issued a decision clarifying when and how evidence of parties’ dealings will be admissible to support arguments before the courts on contractual interpretation. The decision signals a departure from the New Zealand approach to date and the approaches in a number of other Commonwealth jurisdictions, in particular the United Kingdom, and highlights that contracting in New Zealand may give rise to particular practical considerations, both at the time of contracting and also when litigating contractual interpretation issues. Continue reading “A guide to litigating contracts in New Zealand”

Investment limited partnerships in Ireland: the new way forward

The Investment Limited Partnership (Amendment) Act, 2020 (the 2020 Act) brought about much-welcomed updates to the Irish investment limited partnership (ILP) regime, ensuring that the ILP is a modern and efficient partnership vehicle. Continue reading “Investment limited partnerships in Ireland: the new way forward”

Recent changes in the Swiss financial litigation landscape

A new piece of regulation: the entry into force of the FinSA and FinIA

While the financial regulation landscape, inclusive of compliance, has kept evolving and increasing in the past 20 years, the architectural skeleton of the Swiss regulation landscape in this industry was entirely reviewed with the entry into force of two new bills of law on 1 January 2020. As of that date, both the Financial Services Act (FinSA) and the Financial Institutions Act (FinIA) constitute the two main pillars which anchor the main duties of the financial service providers performing a business activity on Swiss soil. The FinIA governs the requirements for acting as a financial institution and provides for statutory rules on the liability of financial institutions in case the latter delegate the performance of a task. The FinSA sets forth the requirements to be complied with within the context of the offering of financial services. Both bills aim at (i) strengthening the attractivity of Switzerland as a financial center as well as (ii) reinforcing the investor protection. As to the liability of financial institutions and their bodies, the FinIA refers to the provisions of the Swiss Code of Obligations (SCO). These two pieces of regulation have set a new landscape in the financial industry encompassing new significant duties, such as the duty to get an authorisation for some actors that were so far exempted (see infra) as well as new duties – entailing a new ground of liability – within the context of public offering of financial products with the duty to issue an offering memorandum complying with specific requirements (see infra). Besides, alternative dispute resolution mechanisms have been strengthened with the duty of financial service providers to inform their clients about the mediation possibility but also to submit to the same in case the client calls for such a mechanism to apply (see infra).

The general grounds of liability in financial disputes between a client and its financial service provider

The most common causes of dispute between customers and banks (and independent wealth managers) relate to breach of contract, mostly to the breach of fiduciary duties. Typical disputes relate to mismanagement of the assets or breach of the duty to inform or the duty of care by the service providers further to losses in investments. The parties will in principle rely on the mandate agreement (Article 394 et seq of the SCO), which applies to most transactions between a financial service provider and its customer.

Non-contractual duties are further set forth in the FinSA and some of those may also ground a dedicated liability towards the client which may thus base a claim on those against its financial service provider. This was notably the case of Article 11 of the Stock Exchange and Securities Dealers Act (SESDA) which anchored the information duty of the financial service provider towards its client. Such piece of regulation was replaced by the FinSA but may still, in some respect, apply until 1 January 2022.

At present, a transitional law regime is in place. Financial services have until 31 December 2021 to comply with the requirements regarding customer segmentation, technical knowledge, code of conduct and provider organisation. As of 1 January 2022, service providers will be fully liable under the obligations governing the offering of financial instruments.

Under the SESDA, Article 11 laid down the main duties of the financial service providers when offering financial products for sale. According to that provision, financial service providers owe their customers a duty of information, a duty of care and a duty of fairness (or fidelity). Based on this Article, the Swiss Federal Supreme Court acknowledged a dedicated liability ground that can be relied upon directly by investors. The Swiss Federal Supreme Court ruled that Article 11 of the SESDA established a dedicated liability ground that customers could rely on directly. As a consequence, the breach of Article 11 of the SESDA could trigger the liability of the financial service providers against their customers irrespective of a contractual management relationship.

Nowadays, Articles 7 et seq of the FinSA provide for a code of conduct imposing new – or more dedicated and specific – duties on financial service providers when providing financial services to retail or professional clients (Articles 4 cum 20 of the FinSA). Among these duties, the FinSA provides for a duty to provide information (Articles 8 et seq of the FinSA), a duty for financial service providers that provide investment advice or portfolio management to assess the appropriateness and suitability of the financial service(s) offered (Articles 10 et seq FinSA), a duty of documentation and of rendering of account (Articles 15 et seq FinSA), as well as a duty of transparency and care in client orders (Articles 17 et seq FinSA).

These provisions, while embodying to some extent prevailing principles that already existed before and had been specified and extended by case law, now clarify such duties. They will certainly give rise to new case law in the future.

An updated and extended ground of liability: the offering memorandum of financial instruments

Title 3 of the FinSA provides for the rules that apply to the offering of financial instruments. These provisions (Articles 35 et seq of the FinSA) now require the publication of a prospectus for all equity and debt securities, including derivatives and structured products, subject to the exceptions expressly provided for in the FinSA.

The FinSA introduced a statutory liability regime which scope is limited to violations of all duties relating to the offering of financial instruments in its Article 69. In this respect, Article 69 of the FinSA provides that any person who fails to exercise due care and thereby furnishes information that is inaccurate, misleading or in violation of statutory requirements in offering memoranda, key information documents or similar communications is liable to the acquirer of a financial instrument for the incurred losses (Article 69 (1) of the FinSA).

With regard to information in overviews, liability is limited to cases where such information is misleading, inaccurate or inconsistent when read together with the other parts of the prospectus (Article 69 (2) of the FinSA).

With regard to false or misleading information on main prospects, liability is limited to cases where such information was provided or distributed against better knowledge or without reference to the uncertainty regarding future developments (Article 69 (3) of the FinSA).

According to the legal doctrine that has so far been published, any violation of its obligations by an issuer shall lead to a quasi-systematic sanction.

Criminal liability under the new FinSA

The FinSA also provides for criminal liability in cases of violation of the code of conduct (Article 89 of the FinSA providing for a fine up to CHF100,000), violation of the regulations on offering memoranda and key information documents (Article 90 of the FinSA providing for a fine up to CHF500,000) and unauthorised offering of financial instruments (Article 91 of the FinSA providing for a fine up to CHF500,000).

The FinIA also provides for a liability regime. Indeed, according to Article 68(1) of the FinIA, the liability of financial institutions and their bodies is based on the provisions of the SCO. Where a financial institution delegates performance of a task to a third party, it remains liable for any losses caused by the latter unless it proves that it took the due care required in that party’s selection, instruction and monitoring (Article 68(2) of the FinIA). Moreover, the fund management company remains liable for the actions of persons to whom it has delegated tasks in accordance with the FinIA as if it had performed those tasks itself (Article 68(1) of the FinIA).

Furthermore, the FinIA also provides for a criminal liability in case of violation of professional confidentiality (Article 69 of the FinIA), of the provisions on protection against confusion, deception and notification duties (Article 70 of the FinIA) as well as violation of the record-keeping and reporting duties (Article 71 of the FinIA).

New alternative dispute resolution mechanism

Any civil claim must first be filed for conciliation (although few exceptions apply). When such conciliation fails (which is usually the case in banking disputes when the amount at stake is of significant value), the claimant is granted with the authorisation to start formal proceedings and file its statement of claim.

The first action, ie the application for conciliation, already creates the lis pendens.

Besides this, the customer may also refer the dispute to the Swiss Banking Ombudsman. The latter acts as a mediator in banking disputes and can be used before starting any litigation. This is, however, not compulsory. The services of the Ombudsman are free of charge. He or she will make a proposal to the parties who are free to accept or decline it. Their rights to then file the claim before courts remain entirely unaffected.

The FinSA also sets forth a new alternative dispute resolution mechanism as it contemplates for mediation. While this new tool is provided for in the FinSA, it however remains facultative and is not compulsory. Typically, there will be no requirement for the parties to first submit their dispute to mediation before starting proper litigation. However, the financial service providers must (i) inform their clients about their faculty to refer any dispute to mediation. Should a client decide to refer a case to mediation, the financial service provider must (ii) comply with such request and cannot refuse to go to mediation.

It remains to be seen how this new tool will be actually used and whether it will prove to be an efficient option for the clients and their service providers to avoid litigation and satisfactorily settle their disputes.

Climate change: boardroom heroes

If, as according to Ian Stewart, chief economist at Deloitte, CFO’s believe that climate transition will re-shape the business environment and more than two-thirds expect significant or wholesale change in their own business as a result of the move to net zero, what do CLOs or general counsel think? Continue reading “Climate change: boardroom heroes”

Revolving doors: Capita appoints new legal chief as Clifford Chance lures back former PE star

In a major in-house move, professional services company Capita has appointed Claire Denton as its new chief general counsel and company secretary.

Denton joins from Aveva Group, where she has been group general counsel and company secretary since 2015. In her new position she will report directly to Capita’s chief executive, Jon Lewis, and will sit on the company’s executive committee. Continue reading “Revolving doors: Capita appoints new legal chief as Clifford Chance lures back former PE star”