Life during law: Shane Gleghorn

My mother is Irish and my father English. They were first-generation immigrants. I was born a year after my mother’s…

My mother is Irish and my father English. They were first-generation immigrants. I was born a year after my mother’s…

Marco Cillario assesses Taylor Wessing’s alliance with Silicon Valley royalty Wilson Sonsini as RPC forges US insurance partnership While the…

Taylor Wessing is entering into an alliance with Silicon Valley firm Wilson Sonsini Goodrich and Rosati. The UK top 20 firm…

The transfer of business services roles into low-cost bases shows no sign of slowdown in 2019, with top 20 UK…

Long-serving managing partner Tim Eyles (pictured) received a nice farewell gift in his last year at the helm of Taylor…

Taylor Wessing is joining the growing list of City firms expanding into low cost centres in the UK by launching an…

In another early sign of a good 2017/18 for UK firms, Taylor Wessing has followed up on a disappointing performance last…

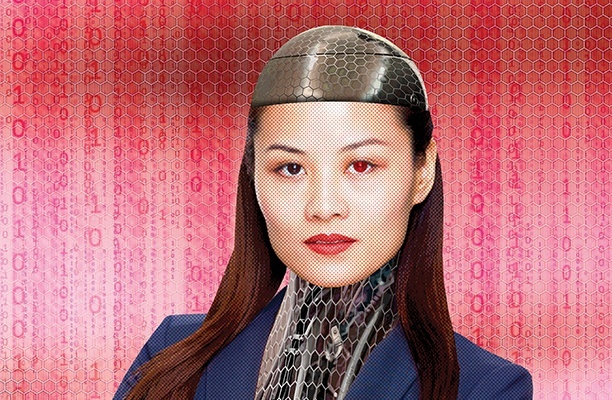

Taylor Wessing has completed its management reshuffle with the election of the law firm’s litigation co-head Shane Gleghorn (pictured) to managing…

LB100 top-30 firms Taylor Wessing, Holman Fenwick Willan (HFW) and Dentons have all announced their Spring partner promotions covering the…

The UK’s top law firms have begun disclosing figures on gender pay gaps, with an initial round of numbers showing…

The latest round of LLP accounts show profit, management pay and remuneration for the highest earning member all fell at…

Days after veteran managing partner Tim Eyles announced he is stepping down next year, Taylor Wessing has elected Dominic FitzPatrick…

With an three terms under his belt it was not a shock that Taylor Wessing’s UK managing partner Tim Eyles…

International law firms have returned from the summer break in acquisition mode, with Berwin Leighton Paisner, Bird & Bird, Taylor…

Taylor Wessing has released further details of its financial performance in 2016/17, showing the modest 1.8% increase in its UK…

Taylor Wessing has posted a modest 1.8% increase in its UK revenue to £128.9m in 2016/2017, in contrast to a…

Travers Smith has unveiled its partner promotions for 2017, with four female associates making the cut. The number is slightly…

In its latest push to provide clients with new technology, Taylor Wessing has launched a data breach mobile app TW:Cyber…

In a push into disputes innovation, Taylor Wessing has started working with legal tech provider Brainspace for UK litigation analysis.

Taylor Wessing has added to its Warsaw office as 39 Essex Chambers brought in a new arbitrator and the New…