Deal View: Warlords in Paris – Kirkland’s long march to the French capital

For a 109-year-old giant that fielded just 12 offices at the beginning of 2017, Kirkland & Ellis has had an…

For a 109-year-old giant that fielded just 12 offices at the beginning of 2017, Kirkland & Ellis has had an…

In probably the worst kept secret in Chicago legal circles, Kirkland & Ellis has confirmed that partner Jon Ballis will become…

After years of internal debate Kirkland & Ellis is to launch in Paris with the hire of one of Linklaters’ key…

Slaughter and May and Kirkland & Ellis have led on the $12bn combination of UK Plc offshore drilling companies Ensco and Rowan…

In a move befitting of its unstoppable upward trajectory, Kirkland & Ellis has scored a new record in partner promotions,…

Though I’ve always known that soul-of-a-law-firm cover features are the biggest draw for our readers, the response to our Kirkland…

City heavyweights Allen & Overy (A&O), Clifford Chance (CC) and Eversheds Sutherland have landed key roles on Legal & General’s £4.4bn…

Though I’ve always known that soul-of-a-law-firm cover features are the biggest draw for our readers, the response to our Kirkland…

They said rapid growth is hard if you are already big. Last year it hiked revenue 19% from $2.65bn. They…

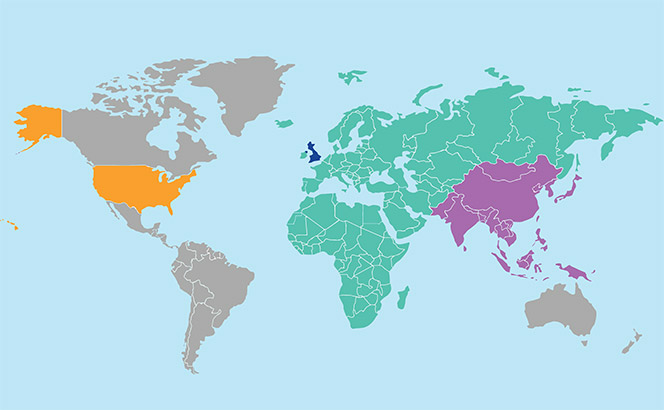

UNITED STATES, 2018 Antitrust Cartel (tier 3) Civil litigation/class actions: defence (tier 1) Merger control (tier 2)

Kirkland & Ellis’ Fortune 100 representation Everyone knows Kirkland has strong ties with financial institutions, but you don’t get to…

Kirkland & Ellis is building on the rapid growth of its Texas operations with the opening of a second office in…

Paul Hastings pulled off two headline lateral hires in London in a week as the US firm strengthens its corporate…

Kirkland & Ellis and Baker McKenzie have secured key roles as Turkish freight shipping operator UN Ro-Ro launched its sale…

Latham & Watkins’ City lateral hires outside its traditional transactional heartlands have been in the news for a while, but…

Fieldfisher, Kirkland & Ellis and Stephenson Harwood were the big winners at the 2018 Legal Business Awards in front of…

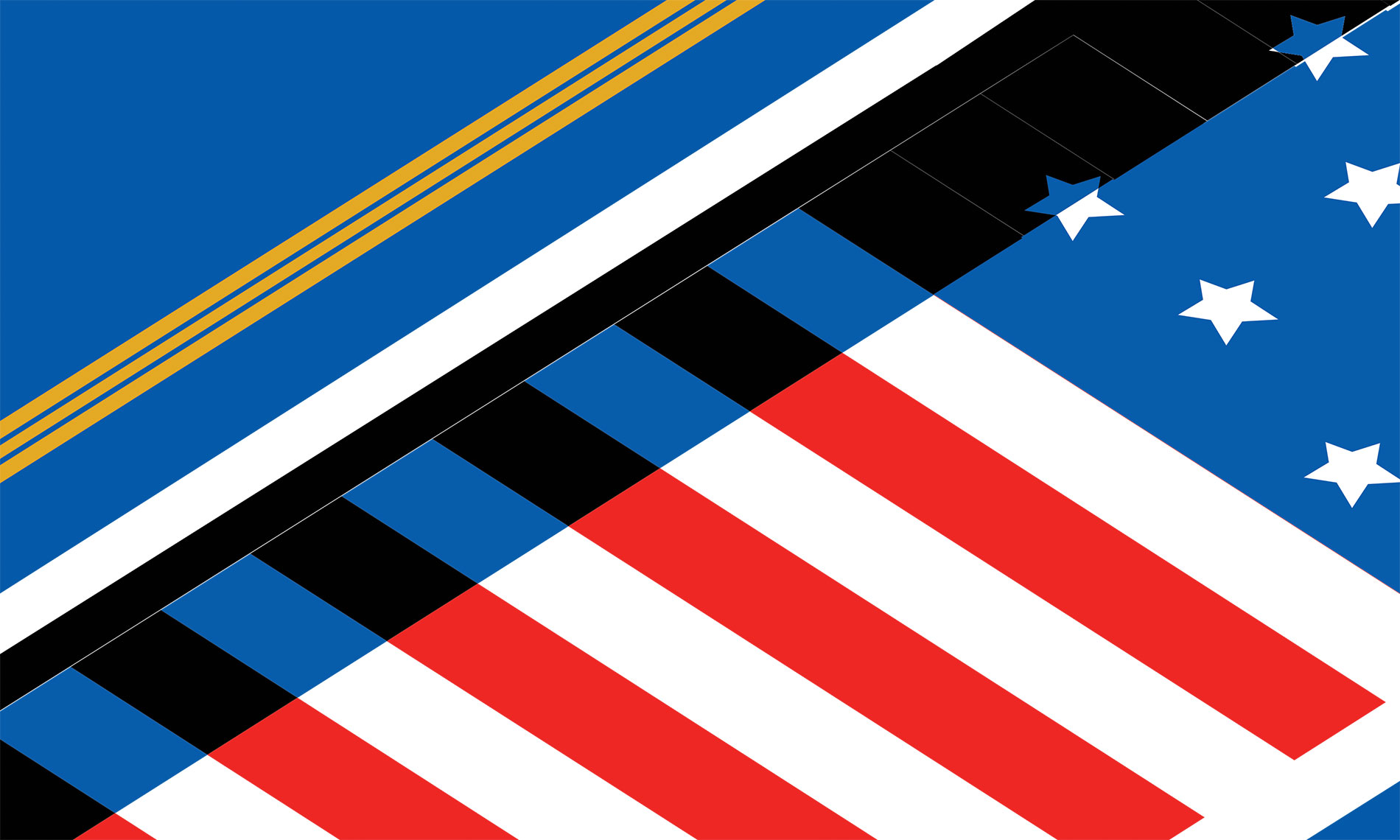

Striking numbers abound in this year’s Global London table, if you are into that kind of thing. The three pace-setting…

Striking numbers abound in this year’s Global London table, if you are into that kind of thing. The three pace-setting…

In a worrying trend for high-street retailers, Toys R Us and Maplin have announced their UK domestic businesses are going…