DWF valued at £366m ahead of £95m IPO this week

DWF will be valued at about £366m when it lists on the main market of the London Stock Exchange this…

DWF will be valued at about £366m when it lists on the main market of the London Stock Exchange this…

Regular readers will have to forgive two columns in one issue on capitalising law firms but the day I write…

Regular readers will have to forgive two columns in one issue on capitalising law firms but the day I write…

DWF is planning to raise around £75m in an expected listing on the London Stock Exchange next month. The firm…

DWF’s equity partners will be paid 40% of what they used to earn in an anticipated stock exchange listing, although…

DWF has appointed a group general counsel (GC) ahead of its touted London Stock Exchange (LSE) listing early next year. Litigation…

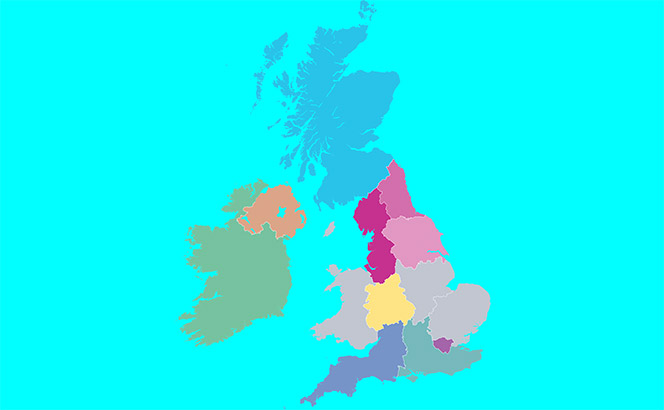

DWF Legal 500 rankings, 2017 DWF announced in June it was considering what would become the largest UK law firm…

DWF’s recent eye for international expansion has been extended to the US through an exclusive association with Los Angeles-based Wood, Smith,…

DWF has added 18% to its top line as the thrusting national operator gears up to become the largest UK law…

National operator DWF has bolstered its services clout ahead of a touted stock exchange listing with the hire of Freshfields Bruckhaus…

Thrusting national operator DWF is gearing up to be the largest UK firm float yet with a London Stock Exchange…

City recruitment was strong last week as DWF and Fladgate followed headline laterals at White & Case and Ashurst with London plays. International…

City recruitment kept pace last week as a trio of firms made City hires, led by Baker McKenzie’s corporate hire…

CMS UK has today (20 November) claimed profits have grown 25% in the six months since its three-way merger with…

A month after recruiting former DLA Piper leader Sir Nigel Knowles, DWF has brought in a senior hand again with…

In contrast to the majority of the top 25 of the Legal Business 100, DWF has been a latecomer to…

It remains extremely rare for law firm leaders to re-emerge at another practice, but then Sir Nigel Knowles has always…

Firms have been busy recruiting in London and abroad, as McGuireWoods and DWF made key London appointments and Jones Day, Hogan Lovells and…

DWF has fulfilled its ambition to enter the South American legal market with new associations in Argentina, Panama and Colombia, following…

DWF takes on four-lawyer Singapore Eversheds team to set up new regional hub DWF has broken into Asia for the…