Levine bids for second managing partner term as DLA kicks off election

DLA Piper’s partnership is headed to the polls again for its managing partner election, less than a year after eight…

DLA Piper’s partnership is headed to the polls again for its managing partner election, less than a year after eight…

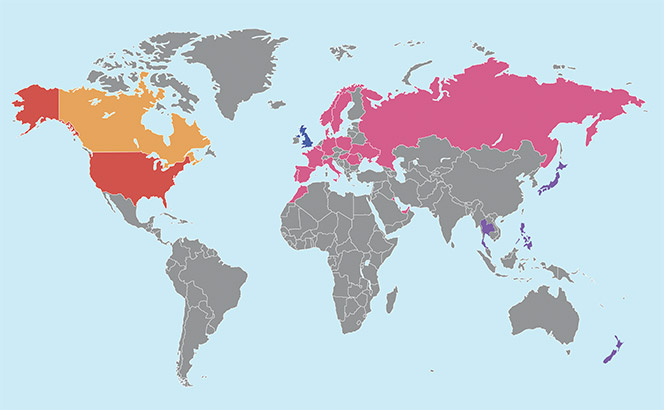

DLA Piper top-tier global rankings from The Legal 500 DLA Piper has topped this year’s Legal Business 100 with revenue…

DLA Piper has hired a former Serious Fraud Office (SFO) division head in response to multinational clients increasingly demanding ‘expertise on…

Mere months after New Law pioneer Lawyers On Demand (LOD) secured private equity backers to position itself as a global…

Shifting to an agile-working office is a peculiar experience. Two camps quickly emerge: those excited by change and colleagues happy…

It has been lively couple of weeks for lateral hires, with Allen & Overy (A&O) making a significant play in New…

City laterals stayed quiet last week continuing a recent hiatus while the US was the centre of attention internationally with…

William Fry’s David Carthy will join the firm to head new office The decision of DLA Piper to join a…

Shifting to an agile-working office is a peculiar experience. Two camps quickly emerge: those excited by change and colleagues happy…

Commitment. Marriage. Honeymoon. Divorce. Conversations about single-supplier legal advisory mandates are rife with relationship-strewn analogies. While no two arrangements are…

Retail’s high street struggles are keeping advisers in the sector busy, as multiple firms took roles on the £18.5bn takeover…

It has been something of a one-way street out of DLA Piper’s London office recently but the global giant believes it…

It has been a bumpy few months for DLA Piper. Just as the dust was settling following McDermott Will &…

DLA Piper has made good on a long-pondered office in Dublin as the firm eyes increased business in Ireland post-Brexit. The…

McDermott Will & Emery is darkening DLA Piper’s door once more, with the hiring of another three partners, shortly after bringing…

DLA Piper has bounced back from last year’s global turnover drop with double-digit percentage growth in net profit and promoted…

The legal adviser overhaul of £13bn real estate business The Crown Estate by general counsel (GC) Rob Booth continues with…

Firms have launched new teams in Paris and Milan on the back of a strong week for European lateral recruitment,…

A trio of tax partners who joined Reed Smith in a 17-partner move from collapsed legacy SJ Berwin have moved…

Hamish McNicol looks at the frontrunners amid a bumper season of senior leadership changes DLA Piper is making up for…