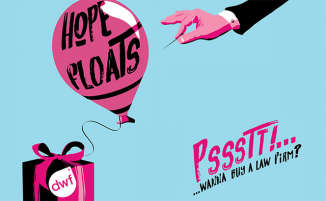

Regular readers will have to forgive two columns in one issue on capitalising law firms but the day I write this piece DWF has finally set out its stall for that much-touted public float. As can be gleaned from last autumn’s cover feature on law firm IPOs, there is a considerable scepticism regarding the rhetoric surrounding DWF’s planned float, which, if it goes ahead, would be on the main market.

Despite initial talk of £1bn valuations, even the more modest £400m-£600m range some were circulating is seen as a huge stretch by a number of the advisers that have worked in this area. Continue reading “It’ll take more than a float to make DWF the new DLA”