It’s been an active start to the week for restructuring lateral moves in the City, as Sidley co-heads Mark Knight and Jifree Cader have joined Davis Polk, and Adam Plainer, co-chair of Dechert’s global restructuring group, has moved to DLA Piper.

It’s been an active start to the week for restructuring lateral moves in the City, as Sidley co-heads Mark Knight and Jifree Cader have joined Davis Polk, and Adam Plainer, co-chair of Dechert’s global restructuring group, has moved to DLA Piper.

Since the A&O Shearman merger went live in May, there has been no shortage of market speculation about which transatlantic duo would be next to tie the knot.

However, few had predicted Monday’s (11 November) news that Herbert Smith Freehills is set to combine with New York’s Kramer Levin, a deal which will create a new $2bn, 2,700-lawyer firm.

The proposed tie-up, which the firms announced in a joint statement, remains subject to a partner vote at both firms, but if confirmed, is set to go live on 1 May next year.

The combined firm will be known as Herbert Smith Freehills Kramer – operating as HSF Kramer in the US – and will operate with one single global profit pool, following in the footsteps of A&O Shearman, which also eschewed the verein model.

While HSF is the much larger of the two firms, with 23 offices across Europe, Asia-Pacific, the Middle East, New York and South Africa, Kramer Levin is the more profitable, with 2023 profit per equity partner of $2.41m (£1.87m), according to law.com, compared to HSF’s 2023-24 figure of £1.315m.

HSF’s revenues of £1.3bn will be boosted by around £330m by the deal, pushing it past the $2bn mark and placing it on the fringes of the world’s 25 largest law firms.

While HSF has had a small New York base since 2012 – the same year the merger between legacy UK firm Herbert Smith and Australia’s Freehills went live – it has long harboured ambitions to bulk up in the States. In a statement, HSF chair and senior partner Rebecca Maslen-Stannage (pictured) described the deal as ‘transformational’.

‘We have long been committed to expanding our offering in the US and Kramer Levin is the perfect fit,’ she said. ‘The combination delivers immediate growth for both firms from day one.’ Global CEO Justin D’Agostino added that the deal was ‘just the beginning… an excellent long-term, strategic move.’

Kramer Levin is led by co-managing partners Howard Spilko and Paul Schoeman, who described the deal as ‘a one-of-a-kind opportunity’, while also citing the firms’ cultural alignment.

In addition to its three US offices in New York, Washington DC and Silicon Valley, Kramer Levin also has a well-established Paris base, which has been in operation since 1999, although this office will be spinning off and will not be part of the merger.

In terms of practice strength, Kramer Levin has five top-tier Legal 500 rankings: advertising and marketing litigation; immigration; land use/zoning and both corporate and municipal restructuring.

The US firm also has rankings for commercial disputes, employment litigation and appellate work, adding heft to HSF’s traditional disputes credentials, as well as transactional capabilities in mid-market M&A and private equity.

Announcing the deal, the firms cited shared strengths in private capital, M&A, restructuring, securitisation, real estate, white collar corporate crime and investigations, class actions, IP, and arbitration.

Lucie Cawood, the head of Travers Smith’s private equity and financial sponsors group, has left the firm, marking the latest in a series of exits from the City firm’s transactional practices.

Cawood has led the firm’s PE group since January 2023, when she succeeded Ian Shawyer, following his move to Cleary Gottlieb Steen & Hamilton. She has spent over 20 years at the firm, making partner in 2012, and was also on the firm’s diversity and inclusion board.

Recent key deals she has been involved in include co-leading on Inflexion’s £342m take-private of DWF last year alongside corporate partners Richard Spedding and Ben Lowen.

In a statement, the firm said that she had decided to retire from the partnership to focus on her family. She will be replaced as practice head by Will Yates, has been at the firm since 2007, making partner in 2015.

Cawood’s departure is another blow for Travers’ private equity practice, which saw the double departure of partners Ian Keefe and George Weavil to Goodwin this spring. Other recent departures include Genna Marten, who joined Linklaters in March 2023, and James Renahan, who moved to Fried Frank in mid-2022, as well as Shawyer’s predecessor as practice head, Paul Dolman, who left for Latham & Watkins in 2021.

Eight partners remain in the firm’s private equity and financial sponsors group – Yates, Victoria Bramall, Alex Dixon, Tom Hartwright, Emma Havas, Adam Orr, Laura Kelly, and managing partner Edmund Reed. The team has recently handled matters such as advising Sixth Street Partners and Patron Capital on the £1.35bn acquisition of Cala Homes from Legal & General, on which Dixon took a lead role.

Yates thanked Cawood for her ‘considerable contribution’ and cited ‘a very busy start to the new financial year’.

‘We are excited and energised to drive the private equity business forward, and build on our enviable client base,’ he said. ‘Our dynamic and flexible approach, coupled with a focus on building long lasting relationships puts us in a great position to pursue, alongside our valued clients, the many opportunities arising from current market dynamics, and to provide the right environment for a fulfilling and enjoyable career in the industry for our people.’

Recent departures from other practices include Mahesh Varia, the head of the firm’s incentives and remuneration group, whose move to A&O Shearman was announced last week (8 November), although the firm did recently secure a boost for its funds team with the hire of Joel Grossmark, who joined from Blackstone Credit and Insurance, where he had led the Europe legal function for five years.

Despite the recent exits, Travers posted strong financials for 2023-24, with a near-10% increase in revenue to £215m and a 18% increase in PEP. The firm cited strong performances across core sectors including disputes and investigations, corporate, M&A and asset management, as well as ‘continued success in private equity’, according to senior partner Andrew Gillen.

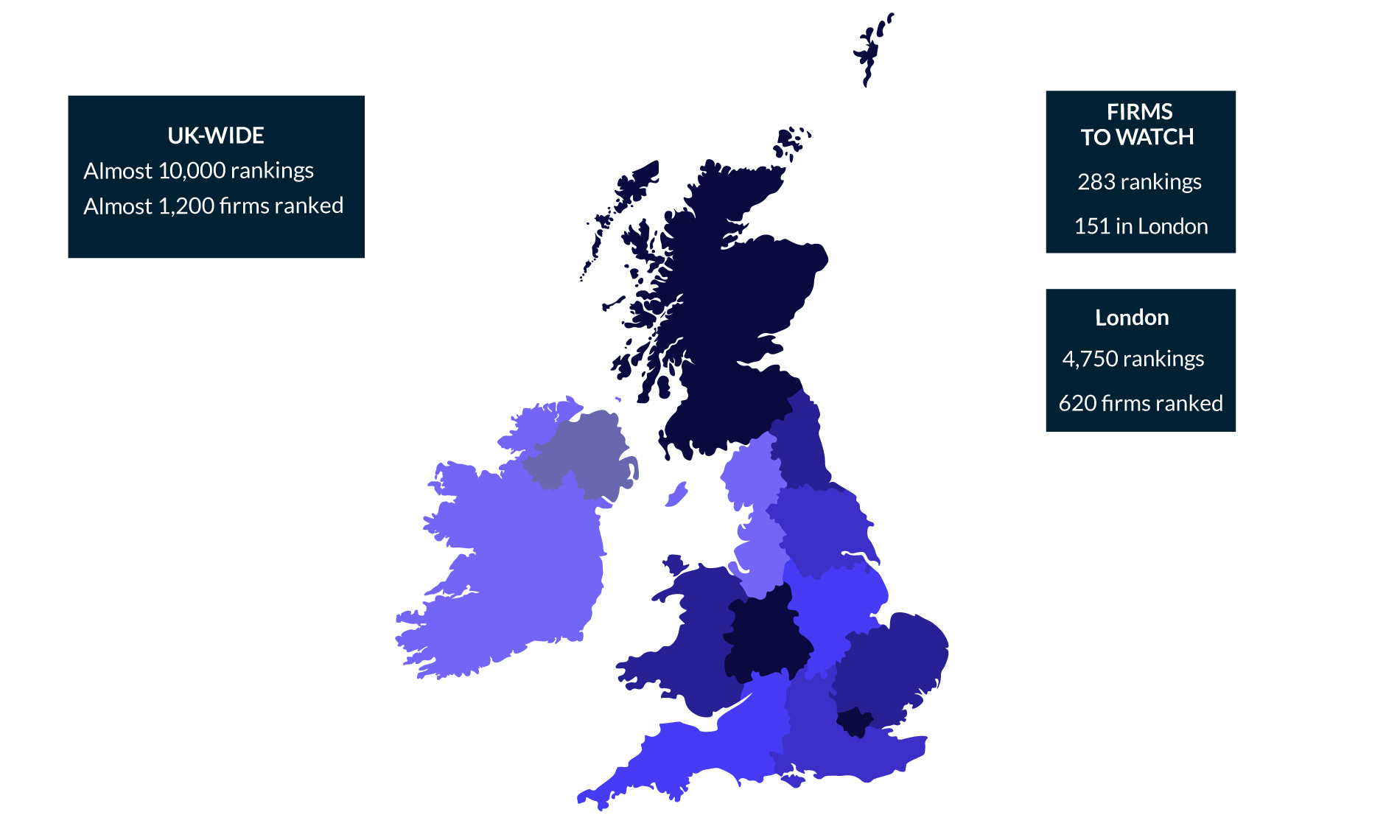

Almost 1,200 law firms have secured spots in the new Legal 500 UK rankings, which have been revealed after months of research into the legal markets up and down the country.

The rankings, which are based on extensive analysis of the legal markets across England, Wales, Scotland and Northern Ireland, have been put together based on the insight gained from rankings submissions, thousands of interviews with firms, and new record levels of feedback from their clients.

The UK guide includes a total of almost 10,000 practice rankings, of which around 50% are in the London section. The rankings feature 1,176 unique law firms and other legal services providers, with 620 ranked in London.

In addition to the practice rankings, there are almost 13,000 rankings for individual lawyers, including around 2,000 deemed worthy of inclusion in the prestigious Hall of Fame.

Referee response rates once again saw double-digit growth this year, soaring to a new high of almost 65,500, 15% up on the equivalent total last year.

In terms of the most well-represented firms, Pinsent Masons has the most practice rankings across the UK as a whole, with Herbert Smith Freehills holding the most rankings in London.

DLA Piper, Eversheds Sutherland, Addleshaw Goddard and Shoosmiths round out the top five most-ranked across the UK, while in London, HSF is followed up by CMS, DLA, Pinsents and Norton Rose Fulbright.

Pinsents has the highest number of top-tier rankings across the UK as a while, while Clifford Chance has maintained its position as the firm with the most tier one rankings in London.

In terms of promotions, lawyers at three firms will be happier than most – Trowers & Hamlins, which achieved 10 promotions, and Eversheds Sutherland and TLT, with nine apiece.

Cameron Purse and Amy Ulliott

To view the editorial commentary of the rankings go to: legal500.com

Freeths, Freshfields and Vodafone were among the big winners at this year’s Legal Business Awards, which were revealed to a packed house at London’s Grosvenor House Hotel.

Twenty-seven prizes were handed out on the night, with the event hosted by BBC journalist, broadcaster and Mastermind host Clive Myrie and introduced by global head of research and reporting Georgina Stanley.

While last year saw the Global 100 struggling against market headwinds, this year finds firms in much ruder health. But with transactional markets yet to make a full recovery, the legal sector could not rely on big deals alone – LB reports on how the world’s largest law firms beat the odds to hit new heights

Key financials for the top 100 firms

In a year of standout performances, Paul Weiss has made more headlines than most with a new international strategy that has shaken up the market, as LB reports

With the battle to recruit and retain star partners becoming ever more intense, the world’s top firms are going to new lengths to fend off the competition. From partnership and lockstep shakeups to spiralling pay packages, LB looks at the measures elite firms are taking to keep rivals at bay.

As part of our Global 100 survey, top lawyers share their thoughts on the global market

The firms that appear in the 2024 Global 100 are the largest 100 law firms in the world ranked by revenue.

The comparison between City partners’ attitudes to the UK general election in July and US partners’ attitudes to next Tuesday’s elections could not be starker. Then, not one partner interviewed doubted that Labour would emerge the winner. Now, it’s a coinflip – with even more uncertainty around what either candidate would do in office.

LB checked in with partners at leading US firms to learn how lawyers and clients are navigating this uncertainty.

McDermott Will & Emery has followed Davis Polk’s lead, raising its London trainee pay to match the highest market rates.

While the US legal market is rarely quiet, post-merger settling at A&O Shearman seems to be driving a spate of activity, with magic circle firm Linklaters among those capitalising on departures to expand their US presence.